Malaysia - Alpha Picks: Convalescing

-

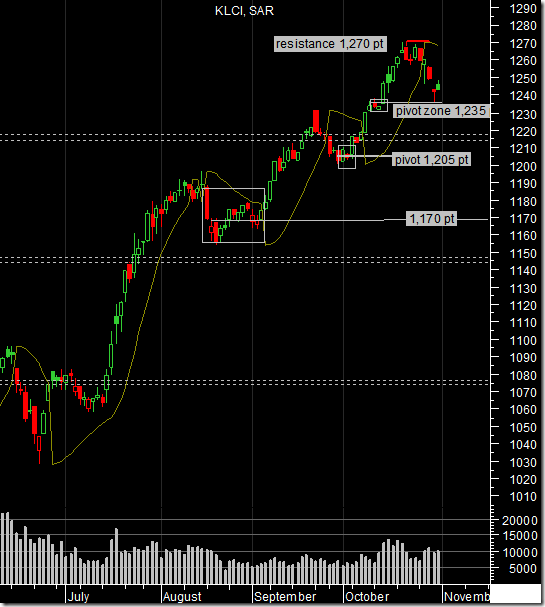

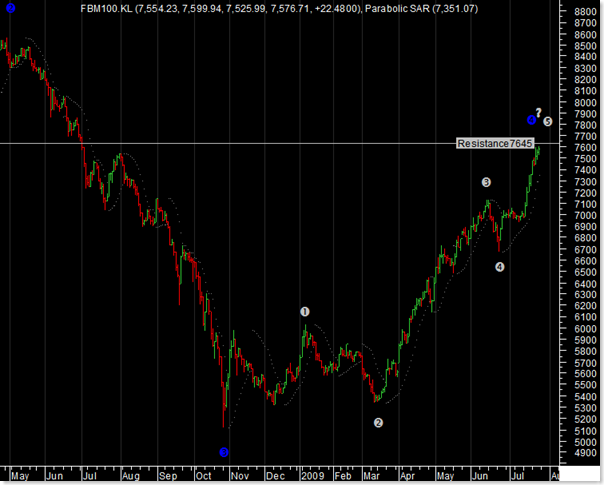

Still convalescing from the heavy selldown post GE, our July alpha picks

delivered a simple average gain of 11.3%, above FBMKLCI’s +5.5%, as the new

govern...

5 years ago